Middlemen Eat Health Care Dollars

Health care in the US is funded by two main payors:

- Government - through Medicare, Medicaid, CHIP, and health plans for federal and state employees

- Businesses - coverage for employees is mandated by federal law for all companies with greater than 50 full-time employees

Patients also pay providers directly, in a model known as self-pay. However this constitutes only 10% of all payments.

Two of the major services funded by these health care dollars are:

- Providers - physicians, nurses, hospitals, practices etc.

- Prescription drugs - produced by pharamceutical manufacturers

In an efficient system, payments would pass directly from payors through to providers and drug manufacturers. Instead, health care payments end up passing through several entities before they reach their intended target. In 2022, the combined revenue of the 9 largest of these intermediaries totalled 45% of the total amount spent on health care in the US1. Each time payments pass through an intermediary, a cut of the total amount is siphoned, and conflicting incentives are introduced to the system.

Cutting out the middle men (i.e. disintermediation) in a given industry has been a core strategy of the playbook used by some of today's major tech companies. Tesla maintains high margins on its cars by cutting out several players from the value chain. Instead of buying a Tesla from a delearship, you can purchase one directly from their website. Instead of having your car serviced by a local mechanic, you take it to a Tesla-owned and operated servicing centre. Rather than purchasing parts for their cars from third-party manufacturers at a huge markup (playfully referred to by Elon as the 'idiot index'), Tesla manufactures many parts, which other car manufacturers would otherwise source from an OEM, themselves. Similarly, Amazon cuts out retailers and sells products directly to consumers. They also have their own logistic network rather than paying distribution companies to deliver all of their products.

Ultimately, disintermediation means fewer parties needing to generate margins, and therefore cheaper prices for consumers.

Intermediaries in health care commonly fall into one of the following buckets:

- Insurers

- Drug wholesalers

- Pharmacy-benefit managers

- Pharmacies

Insurers

Health care insurers provide the service of underwriting the risk of high medical bills. Mainly this service is paid for by employers offering health insurance for their employees. Insurers also offer adminstrative services, like managing claims submitted by providers when a plan member received health care. 4 insurance companies (UnitedHealthcare, Elevance Health, Aetna, and Cigna) make up make up just under 50% of the market. typically take between $0.10 to $0.20 for ever dollar spent on health care.

The insurance market has become consolidated through network effects. Each additional provider that an insurer negotiates a discount with increases the value for patients, who get more choice, and lower costs. Furthermore, each additional plan member means further providers in the insurer's network.

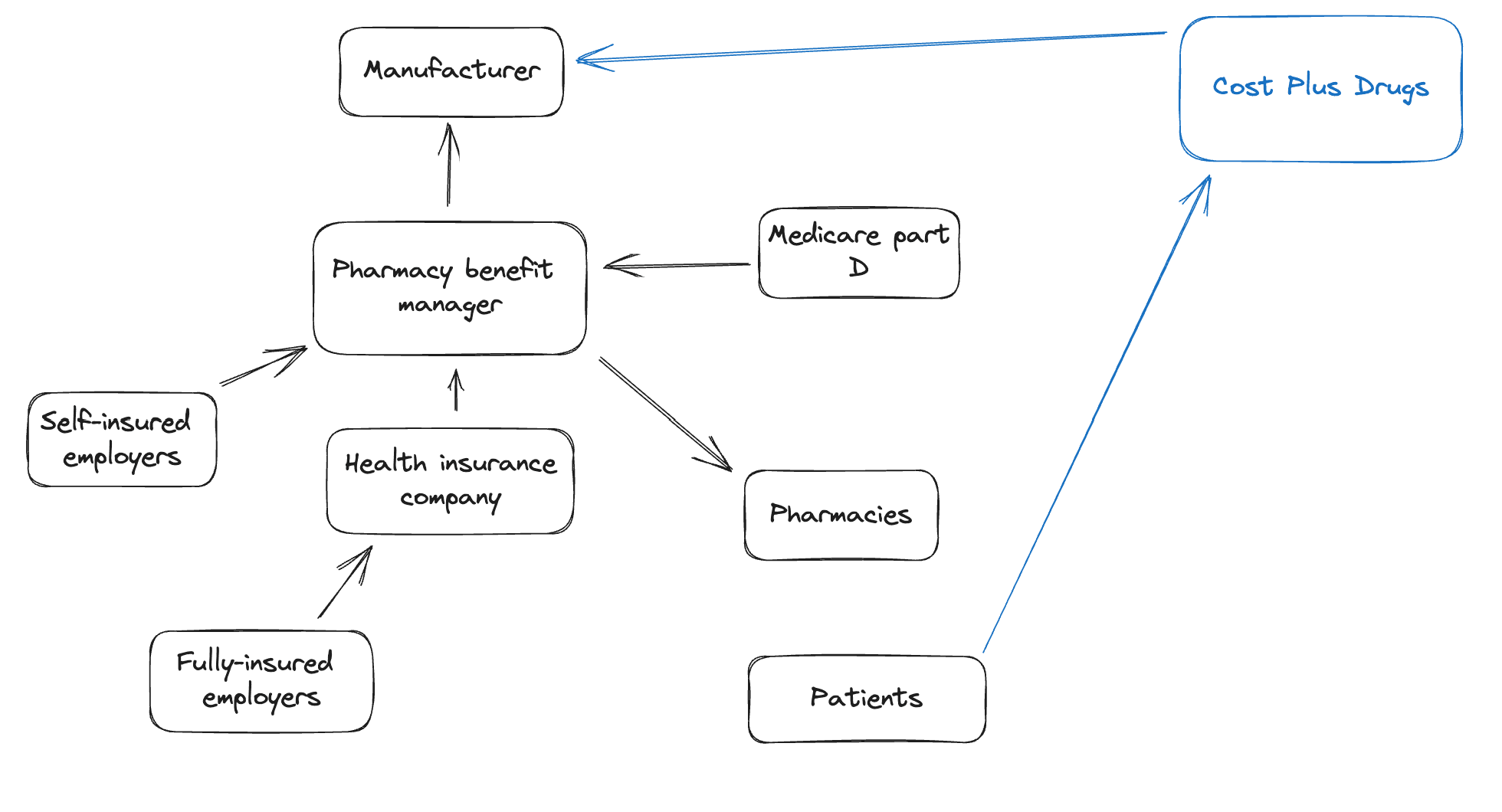

Pharmacy-benefit managers

Pharmacy benefit managers are third party administrators that sit in between payors and drug manufacturers. They fulfill several functions:

- Negotiate with drug manufacturers. They use their elevated buying power resulting from its large customer base to negotitate lower drug prices from manufacturers.

- Process claims. Pharmacies send claims to the PBM, who then adjudicates the claim, and pay pharmacies an amount for the drug (known as the maximum allowable amount).

- Maintain the formulary. The formulary is a list of covered drugs for a health plan. Covered medications range from generics, through to specialty medications (e.g. monocolonal antibodies).

Despite one of the main functions of PBMs being the negotiation of lower prices, much of the negotiation process is shrouded in secrecy. Whilst PBMs negotiate prices lower than the list price from the manufacturer, they never disclose exactly what the saving is.

In recent years, the big insurance players have each acquired their own PBMs. For example, UnitedHealth Group recently purchased Optum, which operates a PBM alongside several other health care services. This procurement in part is because insurers have a legal cap on the profit margin they can earn from companies. The medical loss ratio is a policy that requires insureres to spend at least 80-85% of revenue on paying providers for health care costs, leaving the remaining 10-15% for paying for operational costs and profit. One way to circumvent this cap is to purchase subsidiary companies, like PBMs, which are allowed to generate uncapped profits.

Drug wholesalers

Wholesalers negotiate and purchase medications directly from manufacturers. They supply smaller retail pharmacies, and typically take $0.12 of every dollar spent on prescription medications2.

Pharmacies

Typically, when you want to collect a prescription, you go to a brick-and-mortar store. Bigger players (like CVS or Walgreens) receive prescription drugs directly from manufacturers, with which they negotiate prices. Smaller, local retailers, don't have the power to contract directly with manufacturers, so instead go to wholesale distributors. $0.17 of each dollar spent as part of Medicare Part D goes to pharmacies2.

Single payor system

Rather than have private insurers receive and disburse health care dollars, many European countries have a single payor that directly pays providers and negotiates drug prices with drug manufacturers. In the UK, the NHS is the single payor for all health care services (excluding a very small but rapidly growing private segment). The system is funded through taxation, and sets prices for all health care services. Whilst some argue that the public operation of health care facilities results in systems that are run less efficiently, incentives are generally much better oriented towards the provision of quality health care, and providers are not required to generate a margin each year. As such the cost of health care is tends to be much lower in European countries (around 10% of GDP) compared to the US (18% of GDP) for better quality health care.

Direct payments

Business models to eliminate intermediaries from the prescription drug supply chain offer an opportunity to cut costs. The Mark Cuban Cost Plus Drug Company purchases medications directly from manufacturers, then sells them directly to patients at cost + 15% + $5 dispensing fee + $5 delivery fee3. They are further looking to capture more upstream territory of the drug supply chain by carrying out the 'fill-and-finish' of the manufacturing process themselves, having initiated construction of an $11 million facility in Dallas in 2021.

Furthermore, a number of options now exist for patients to pay for primary care without claiming on their insurance (known as direct primary care). A number of telehealth providers offer fee-for-service (around $50) online consultations with both primary care physicians and providers. Additionally, independent primary care practices now offer patients a monthly subscription (around $100) to get all-you-can-use primary care.